Client Background: A multinational real estate investment trust managing $2.8 billion in commercial and residential properties across North America and Europe required comprehensive market intelligence to optimize their acquisition strategy and improve portfolio performance.

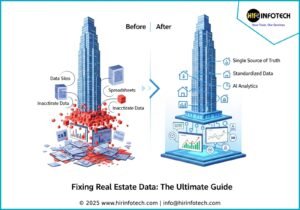

Challenge: The client struggled with fragmented data sources, inconsistent property valuations, and delayed market insights that hindered strategic decision-making. Manual data collection processes consumed excessive resources while providing incomplete market coverage, resulting in missed opportunities and suboptimal investment timing.

Solution: We implemented a comprehensive real estate data scraping solution covering 85+ property platforms across the USA, UK, Germany, and France. Our AI-powered system extracted property details, pricing trends, rental yields, and market demographics, delivering structured data through custom APIs integrated with their investment management platform.

Results: The client achieved a 35% improvement in portfolio performance, reduced data collection costs by 60%, and accelerated acquisition decision-making by 40%. Enhanced market intelligence enabled identification of undervalued assets worth $450 million in previously overlooked markets.

Client Testimonial: “Hir Infotech’s data intelligence platform transformed our investment strategy. The comprehensive market insights and real-time analytics enable us to identify opportunities our competitors miss while managing risk more effectively.”

Client Background: An innovative PropTech company based in San Francisco developing an AI-powered property valuation platform for real estate professionals and individual investors seeking accurate, real-time property assessments.

Challenge: The startup needed access to comprehensive property data from multiple sources to train their machine learning models and provide accurate valuations. Limited technical resources and tight budget constraints prevented effective data acquisition and processing capabilities.

Solution: Our team deployed a scalable data extraction infrastructure covering 120+ real estate platforms across the USA and Canada. We provided structured property data including sales history, listing details, neighborhood statistics, and market trends through cost-effective API access tailored to startup requirements.

Results: The client successfully launched their platform, attracting 50,000+ registered users within 18 months. Accurate data-driven valuations achieved 94% correlation with actual market prices, leading to $3.2 million in Series A funding and expansion into five additional metropolitan markets.

Client Testimonial: “Without Hir Infotech’s comprehensive data solutions, our platform wouldn’t exist. Their reliable, high-quality property data is the foundation of our success and competitive differentiation.”

Client Background: A prominent real estate agency network operating across Germany, France, and Netherlands with 200+ agents serving residential and commercial markets required enhanced lead generation and market intelligence capabilities.

Challenge: The agency network faced declining lead quality, limited market visibility, and inefficient prospecting processes. Traditional marketing approaches generated insufficient qualified leads while competitors gained market share through data-driven strategies and superior market intelligence.

Solution: We implemented targeted real estate data scraping focused on property listings, seller contact information, and market trends across their operational territories. Our solution included automated lead scoring, market analysis reports, and competitive intelligence dashboards integrated with their CRM system.

Results: Lead generation increased by 140% with 60% improvement in conversion rates. Market intelligence capabilities enabled strategic pricing decisions that improved average transaction values by 25%. The network expanded operations to two additional countries based on data-driven market opportunity analysis.

Client Testimonial: “The comprehensive market intelligence and lead generation capabilities provided by Hir Infotech revolutionized our business operations. We’ve never been more competitive or profitable.”

Client Background: A major property development company in Australia specializing in residential and mixed-use projects required comprehensive market data to support site selection, feasibility analysis, and project planning across Sydney, Melbourne, and Brisbane markets.

Challenge: The client lacked systematic access to property sales data, demographic trends, and development pipeline information necessary for informed site selection decisions. Manual research processes delayed project timelines while increasing development risks and market uncertainty.

Solution: Our team created a comprehensive data collection system covering Australian property markets, including sales transactions, development applications, demographic data, and infrastructure projects. Custom analytics dashboards provided actionable insights for site evaluation and market timing decisions.

Results: Site selection accuracy improved by 45%, reducing development risks and optimizing project returns. Data-driven feasibility analysis identified $85 million in additional development opportunities while avoiding three high-risk projects that subsequently underperformed market expectations.

Client Testimonial: “Hir Infotech’s market intelligence platform is indispensable for our development decisions. The comprehensive data and analytics have significantly improved our project success rates and profitability.”

Client Background: A leading commercial real estate services firm providing advisory, leasing, and investment services to corporate clients and institutional investors across major US metropolitan markets required enhanced market intelligence capabilities.

Challenge: The firm needed comprehensive commercial property data to support client advisory services, market analysis, and investment recommendations. Existing data sources provided limited coverage and outdated information, compromising service quality and client satisfaction.

Solution: We developed a specialized commercial real estate data extraction system covering office, retail, industrial, and mixed-use properties across 25+ major US markets. The solution included lease rates, vacancy statistics, property specifications, and transaction data integrated with their advisory platform.

Results: Client advisory quality improved significantly with comprehensive market intelligence supporting strategic recommendations. New business acquisition increased by 30% while client retention reached 95%. Enhanced data capabilities enabled expansion into three additional metropolitan markets.

Client Testimonial: “The depth and accuracy of market intelligence provided by Hir Infotech enables us to deliver exceptional value to our clients. Our advisory services are now considered industry-leading.”

Client Background: A digital real estate investment platform enabling fractional property investment for retail investors required comprehensive property data to support investment opportunities, due diligence, and performance tracking across multiple markets.

Challenge: The platform needed reliable property valuation data, rental income projections, and market trend analysis to evaluate investment opportunities and provide transparent performance reporting to investors. Data quality and consistency were critical for regulatory compliance and investor confidence.

Solution: Our comprehensive data scraping solution provided property valuations, rental market data, neighborhood analytics, and historical performance metrics integrated with their investment platform. Advanced data validation and quality assurance processes ensured accuracy and regulatory compliance.

Results: The platform grew assets under management from $15 million to over $115 million within two years. Enhanced data-driven investment selection achieved average annual returns of 12.8%, exceeding market benchmarks and attracting institutional capital partnerships.

Client Testimonial: “Hir Infotech’s comprehensive property data infrastructure enabled our platform’s exceptional growth. Investors trust our data-driven approach and transparent performance reporting.”

Client Background: A property management company overseeing 15,000+ multi-family units across Texas, Florida, and Georgia required market intelligence to optimize rental pricing, tenant acquisition, and property performance across their portfolio.

Challenge: The company lacked systematic access to rental market data, competitor pricing, and tenant demand patterns necessary for optimizing rental strategies and maintaining competitive occupancy rates. Manual market research consumed significant resources while providing incomplete insights.

Solution: We implemented automated rental market data collection covering their operational markets, including competitor pricing, vacancy rates, amenity comparisons, and tenant demographic trends. Custom analytics dashboards enabled data-driven pricing and marketing decisions at the property level.

Results: Average rental income increased by 18% through optimized pricing strategies while maintaining 96% occupancy rates. Tenant acquisition costs decreased by 25% through targeted marketing based on demographic and demand analysis. Overall portfolio performance improved by 22%.

Client Testimonial: “The comprehensive rental market intelligence from Hir Infotech transformed our pricing strategy and operational efficiency. We’ve never been more competitive in our markets.”